This post may seem a little dry in its subject matter, but Bonds are an important part of every economy, and ESG Bonds are equally important as we move toward a circular economy. So, hang in there because there is value in understanding these important sustainability investing tools. First, though, we must understand what a Bond is. An ESG bond is a debt security issued by an investment fund that invests in companies with high environmental, social, and governance standards. These funds are often referred to as “socially responsible” or “environmentally friendly” investments.

ESG bonds have several advantages over other types of corporate debt securities: more favorable tax treatment, greater transparency on financial information and performance, and higher credit ratings from rating agencies which can lead to lower interest rates for investors.

What does ESG stand for?

ESG is an acronym that stands for “environmental, social, and governance”. It refers to a set of criteria that companies must meet in order to qualify as environmentally or socially responsible.

- Environmental criteria include factors such as carbon footprint, energy efficiency, use of recycled materials, and conservation activities. a socially responsible way

- Social criteria include topics like labor standards, community involvement, and product safety.

- Governance criteria include corporate social responsibility reporting, diversity initiatives, and executive compensation policies.

- What does ESG stand for?

- Where can I invest in ESG Bonds?

- What are the risks of ESG Bonds?

- What is ESG fixed income?

- What are examples of sustainable investment methodologies that are used by ESG fixed-income managers?

What are the benefits of ESG Bonds?

There are a number of reasons why investors choose to invest in ESG bonds:

1. An ESG bond is a predictable fixed-income security, which means the amount paid out every period will not change since it’s tied to a rate and schedule set at the time of issuance. This makes it easier for investors as they know exactly what return to expect.

2. ESG bonds are low-risk assets compared to other fixed-income investments since they are typically investment-grade securities, meaning that the credit risk is lower.

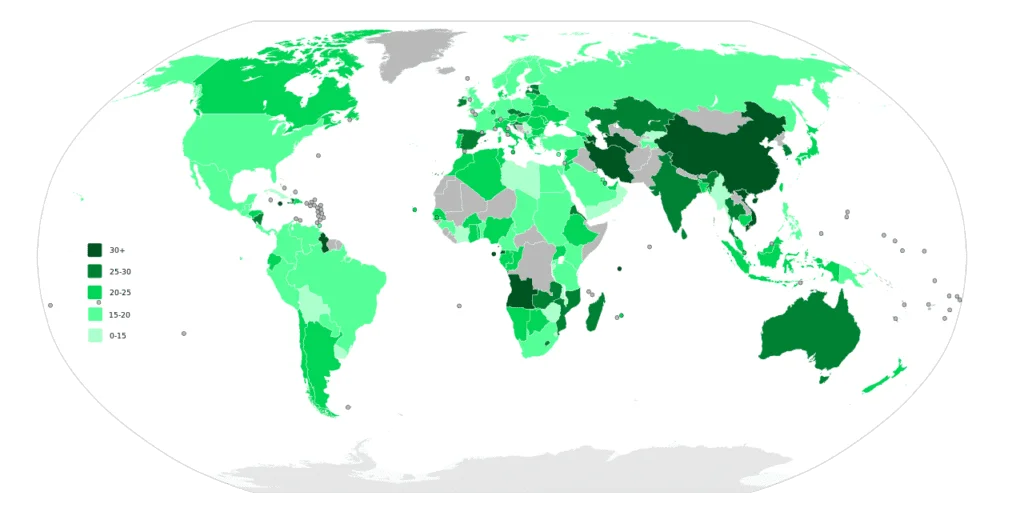

3. The tax exemption for ESG bonds varies depending on the issuer but can be as high as 30%. For example, in Canada, this means that investors do not have to pay taxes on the interest they receive, which increases the after-tax return that they will receive. In the United States, some states exempt interest from state tax as well, such as California and New Jersey.

4. Standard & Poor’s, Moody’s, and Fitch assign higher ratings to ESG bonds than they do for traditional corporate bonds with similar risk profiles. This means that investors can often receive a lower interest rate on their investments or purchase the issue at a lower dollar price per unit than with traditional corporate bonds.

5. ESG Bonds provide investors the opportunity to invest in assets that demonstrate social and environmental responsibility, which aligns their investments with their personal values and ethical concerns.

6. Investors looking to diversify their portfolio may want to consider adding ESG bonds into their investment plan. This can help offset the volatility of traditional bond investments and provide opportunities to generate higher returns.

7. ESG bond funds are liquid which means they can be sold at any time, however, this also means that their prices fluctuate with the market.

8. ESG bond issuers are obliged to provide detailed information about their investment strategy and performance through yearly reports, press releases, and other documentation. This transparency allows investors to see exactly what kind of companies their investments are supporting.

Savvy investors copy top-performing traders. When they trade, you trade.

Choose a broker based in the region where you reside.

eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

Socially Responsible Investing Platform – CA

Copy Trading Platform – UK & EU

ESG & Sustainable Investing Platform – UK & EU

Copy Trading Platform – Global

ESG & Sustainable Investment Platform- Global

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

How do sustainability bonds work?

Simply put, sustainability bonds are created to fund or refinance green projects that emit less carbon dioxide and other greenhouse gases into the atmosphere. These bonds are essentially a way to “green” your money as opposed to buying traditional investments such as stocks, bonds, mutual funds, etc. In addition, these types of investments help you reduce any negative impact on the environment while making a profit at the same time.

Some of the most popular issuers of ESG notes are large corporations such as Kellogg, Apple, Walmart, and Google which all have issued corporate green bonds to finance projects that reduce emissions, energy consumption, waste, etc. By issuing these types of investments big companies can save money on debt repayment while also improving their overall reputation for being eco-friendly.

ESG issues are also attractive to large institutional investors such as funds, insurance companies, and banks since they are easy to trade on the bond market, have a longer maturity date of up to 30 years, don’t require an environmental analysis by the issuer, etc. Additionally, ESG bonds attract many smaller investors who wish to participate in the ” green bond market ” which is estimated to pass 1 Trillion.

An ESG or Sustainable Bond is typically defined by the issuer, in other words, the organization issuing the note must adhere to specific guidelines when they come up with their overall strategy of maximizing profits while also minimizing environmental impact. There are many laws in place in the United States and abroad that are designed to encourage green initiatives by corporations, government agencies, etc.

ESG investments are attractive because they have an estimated return of 2-3% higher than traditional bonds while also satisfying the financial goals of environmentally conscious individuals who want to invest in companies that are making an effort to reduce their greenhouse gas emissions.

Who issues ESG Bonds?

ESG bonds can be issued by corporations, governments, supranational or investment funds. Corporations can use ESG bonds to finance projects with positive environmental and social impacts, while governments may issue them to finance infrastructure projects that benefit society. Investment banks may also create special purpose vehicles (SPVs) or sub-investment grade-rated companies that follow sustainable business practices in order to issue ESG bonds.

Where can I invest in ESG Bonds?

ESG bond funds can be purchased from a variety of financial institutions such as wealth management advisors, investment dealers, and online brokerages. Online brokers such as Questrade offer some of the lowest fees on the market today so investors can get started at a low cost.

Are ESG and green bonds the same?

An ESG bond may also be called a “green bond,” but these two terms are not interchangeable because green bonds may or may not be backed by collateral such as stocks or real estate.

Green bonds, (like the Climate Bond Initiative), generally offer investors the opportunity to invest in projects like renewable energy initiatives, sustainable agriculture and clean water technology. Whereas ESG bonds generally target companies that meet specific environmental and social requirements, such as those in the technology, entertainment or apparel industries. They are not limited to environmental initiatives alone.

Does an ESG bond follow a particular schedule?

ESG bond schedules may be different depending on the issuer and type of security issued. An ESG bond will follow the typical bond schedule for repayment of principal and coupon payments. However, some may be issued with a step-up coupon which allows interest payments to rise over time. This can help compensate issuers for initial higher costs associated with adopting sustainable practices, but it also means that investors may have to wait a longer time for their investments to mature.

Why is the interest rate different on an ESG bond?

Since it can take time and resources for an issuer to adopt sustainable business practices, they may need more financing than a traditional company. Additionally, since ESG bonds often focus on projects in the renewable energy industry, they can be more sensitive to interest rates than traditional bond issuers due to fluctuating oil prices. Investors should carefully research their investment before purchasing an ESG bond if they are considering it as part of an investment plan.

How do ESG Bonds differ from other fixed-income securities?

ESG bonds can be considered a type of “socially responsible investing” or SRI. However, the difference between ESG and other types of socially responsible investments is that investors may receive a return on their investment while also supporting qualified sustainable developments.

An ESG bond is often seen as a more accessible type of investment in the SRI sector because it offers diversification benefits and can be purchased with lower minimums. It also provides investors with exposure to new industries, such as renewable energy, which is becoming increasingly important for business strategies.

What are the risks of ESG Bonds?

ESG bonds are not without risk. In addition to the typical risks associated with fixed-income securities, there are additional risks involved in investing in ESG bonds. Some of these include:

- Political – An issuer’s ability to pay the interest and repay the principal may be influenced by a change in government or corporate policy.

- Market – The market for ESG bonds is still relatively new and it may take time for investors to recognize their value. Since ESG bond prices are more sensitive to interest rate movements, ESG bonds may not be appropriate for all portfolios.

- Sustainability – While sustainable business practices offer benefits for an issuer’s reputation, product offering, and investor relations, they can also be more expensive than traditional business practices. Depending on the nature of the sustainable development, this may result in financial risk for the issuer.

Savvy Investors are also reading…

The Best Sites to Learn How the Markets Work

The Best Artificial Intelligence Investing Sites

The Best Supported Algorithm or Quant Trading Sites

What are some examples of ESG Bonds?

The first ESG bond was issued in 2007 by the European Investment Bank, the EU’s lending arm. Since then many others have followed suit. The largest issuer is probably AXA, a financial services company headquartered in France. They issued a total of €3 billion ($3.7 billion) in ESG bonds in 2014, and have been issuing environmental bonds since 2010. Some of the other major issuers include KfW, JN Bank, and EIB.

Why do investors want to invest in ESG bonds?

Many people in the investment community think that ESG is just about “ethics” and doing what’s right. That’s definitely part of it, but when thinking about ESG in an asset-management context we should be thinking about how ESG issues impact a company’s financials: how efficient the business is (i.e. cost to produce good or service), how much growth we can expect (and for how long), and ultimately the return on investment.

To give you one specific example, consider a company like Walmart. They’re an efficient business that is able to produce at incredibly low costs because of their economies of scale [the company makes more money when they make more sales]. This has the net effect of being good for their ‘bottom line’ but it also means they have very low-paying jobs which are often non-unionized. This has the consequence of being bad for employees, but since Walmart’s return on investment is so high, its stock price reflects the positive financial impact of these efficiency gains.

Investors interested in ESG issues may be interested in companies like Walmart, but they want to know how those efficiency gains are impacting the lives of employees and whether those employees will one day be able to afford Walmart goods. Without regulation, shareholders can’t really expect management teams to solve these social problems so investors look for shareholder engagement as a way to resolve those conflicts.

What is ESG fixed income?

ESG fixed income refers to investment products that are developed with the aim of supporting companies that adhere to environmental, social, and governance (ESG) criteria. ESG factors are incorporated into the selection process for identifying bond issuers, in addition to traditional credit risk analysis.

Why invest in ESG fixed income?

The rationale for investing in ESG fixed income is based on the desire to align investment returns with ethical, environmental, and social goals. For investors who are not comfortable with simply purchasing green products, ESG fixed income offers a lower-risk alternative for implementing your sustainable investment strategy.

What types of companies does ESG fixed income typically invest in?

ESG fixed income targets bonds issued by companies that have a strong record of adhering to sustainable business practices. Such companies have been ranked as leaders in the areas of corporate governance, employee relations, supply chain management, environmental impact, and community investment.

How can I invest in ESG fixed income?

The simplest way is to purchase a product that tracks an ESG-focused index, such as the Sustainability Bond Index. Alternatively, investors can seek out fund managers with strong ESG credentials and build their portfolios accordingly.

What are the risks associated with investing in ESG fixed income?

The main risk is that companies with the strongest ESG records may not necessarily offer the highest returns, compared to other bonds in the fixed-income market. If an issuer’s ESG record is not strong, it could be that the company is less financially stable or has more limited access to capital markets.

There are also risks associated with climate change and other environmental factors. While ESG fixed income is likely to provide better protection against these risks than general fixed income products, investors should consider the extent to which these risks are already reflected in their portfolios.

In addition, ESG factors may not be considered by all investors as an important element of their investment decision-making. In such cases, ESG fixed income will have lower appeal and could see smaller inflows from retail investors.

How do I choose a product that invests in ESG fixed income?

In addition to the product’s focus on investment quality, there are a number of factors that you may want to consider. These include liquidity, trading costs, and fees, as well as how the product is managed and whether it has been designed with your needs in mind. Access to expert advice that can help you assess these and other product features will also be important.

ESG fixed-income products are offered through various channels, including traditional retail distribution such as banks and brokerages. They may also be available through online issuers or platforms. You should understand your position as an investor with each distributor before purchasing the product. For example, some distributors sell ESG fixed income via ‘wrap’ accounts, which involve them managing your investments according to their own investment strategy.

How do you integrate ESG into fixed income?

ESG fixed-income investment managers may use ESG information in the following ways.

Managers can screen their portfolio of securities to ensure they meet certain ESG criteria, such as a low carbon footprint or good environmental policies. In many cases, these criteria are incorporated into investment processes in addition to traditional credit risk factors when assessing issuers’ creditworthiness.

Managers may also apply sustainable investment methodologies to increase their exposure to ESG-focused companies or sectors, such as renewable energy.

Finally, managers can conduct engagement activities with issuers, particularly if the issuer is not meeting sustainability requirements or has unclear reporting of ESG efforts. This can help promote transparency and encourage better performance over time.

ESG fixed-income managers may also take into account climate change risk when making investment decisions, but this is not always straightforward. For example, managers with exposure to the energy value chain would be expected to consider how investments in fossil fuel sources could be affected by climate change policies. This can include assessing how policies aimed at mitigating carbon emissions could impact on valuations of companies in this sector.

Managers may also utilize ESG score data when assessing the risk of natural disasters, such as earthquakes or floods.

What are examples of sustainable investment methodologies that are used by ESG fixed-income managers?

There are often opportunities for the use of sustainable investment methodologies within ESG fixed-income investment portfolios. Managers may use the following methodologies to increase exposure to ESG companies or sectors or improve the valuations of sustainable portfolio companies.

Renewable Energy

To begin with, renewable energy is an area that requires a high level of skill from managers as they are heavily invested in eco-friendly technologies. This can result in successful and sustainable investments being made.

Renewable Energy Access

Managers can use this approach to gain exposure to renewable energy companies, such as those that specialize in the production of clean fuels and technologies. Whether it be an assessment of how managers might decrease their carbon footprint or invest in greener forms of electricity generation, there are many ways they may show their dedication to sustainability.

Renewable Energy Value Chain

Thirdly, this methodology can be used to increase exposure to issuers that are involved in the production of clean fuels and technologies. These could include companies that have a high dependency on wind, solar, or ocean power. This approach can help managers to assess how environmental policies will impact these institutions and their portfolios.

Renewable Energy Sub-Sector

The RE sub-sector is used to increase exposure to certain subs of the renewable energy industry, such as electricity generating companies or providers of clean fuel. This approach can help managers assess how environmental policies will impact these institutions and their portfolios.

Sustainable Forestry

Managers may use this methodology to achieve exposure to sustainable forestry activities. This can include the assessment of forestry companies that implement sustainable harvesting practices and meet certain environmental standards. This approach can help managers to assess how environmental policies will impact these institutions and their portfolios.

Sustainable Water

FI Managers may use this methodology to increase exposure to issuers in the water sector, such as those involved in desalination or recycling facilities. This can help to assess how environmental policies will affect these institutions and their portfolios. This approach can also be used by managers with an interest in water treatment companies or those who are responsible for dealing with stormwater management.

Sustainable Agriculture

Since Agriculture is one of the largest and most important industries for our collective sustainability, managers can use this methodology to increase exposure to companies involved in sustainable agriculture practices, such as organic food providers or organic fertilizer producers. This approach can help managers assess how environmental policies will impact these institutions and their portfolios.

Sustainable Fishing

Managers may use this methodology to increase exposure to companies involved in sustainable fishing practices, such as those that are involved with processes that minimize the damage done to habitats or marine life. Managers can also use this methodology to assess how environmental policies will impact these institutions and their portfolios.

Gender Diversity

This method involves assessing companies based on a number of factors, including gender diversity statistics across all levels of management. Having a high proportion of women in senior positions can help to improve the decision-making process as well as financial performance. This could include the ethical assessment of the overall company culture.

This approach can also be used by managers with an interest in companies that are family-friendly or those that adopt flexible working hours across all levels of management.

Environmental Impact

This methodology is used to assess how environmentally friendly certain companies are, including their impact on ecosystems and habitats as well as overall carbon emissions. This approach can help managers assess how environmental policies will impact these institutions and their portfolios.

Ethical Impact

This method involves assessing companies based on several factors, such as ethics, values, and overall compliance with legal frameworks, such as those set out by the OECD Guidelines for Multinational Enterprises. This approach can also include the assessment of how ethical a company is from an employee standpoint.

This methodology can be used to help managers assess companies with a proven commitment to ethical business practices and those that adhere to the highest possible standards in terms of ethics, values, and compliance with legal frameworks.

Corporate Governance

Managers may use this approach when assessing the quality of corporate governance across certain companies, including the leaders and directors of these institutions. This would include an assessment of potential risk factors and ways in which these risks may impact the company’s long-term performance.

This approach could also help managers assess whether a company complies with minimum standards for corporate governance or those set out by the International Corporate Governance Network (ICGN).

You may also want to read

In conclusion on bond funds, investment strategy, and an institutional investor…

So what’s the verdict? ESG bonds are a great investment for companies and investors alike. The tax benefits, transparency, and higher credit ratings make these bonds an attractive option for anyone looking to invest in corporate debt securities. If you’re feeling overwhelmed by this topic or simply want more information on how to get started with ESG investing, don’t worry. We know that it can be confusing, but there are easy ways to get help.

Dean Emerick is a curator on sustainability issues with ESG The Report, an online resource for SMEs and Investment professionals focusing on ESG principles. Their primary goal is to help middle-market companies automate Impact Reporting with ESG Software. Leveraging the power of AI, machine learning, and AWS to transition to a sustainable business model. Serving clients in the United States, Canada, UK, Europe, and the global community. If you want to get started, don’t forget to Get the Checklist! ✅