Best AI Trading Software

The Best AI Trading Software for Sustainable Investments

If you’re looking for the best AI trading software to help increase your profits, you’ve come to the right place. In this blog post, we will discuss some of the most popular AI trading software programs available and how they can help you make more money. We’ll also talk about some of the features that you should look for when choosing a trading software program, as well as the benefits of using AI Trading Software. So, if you’re ready to start making more money with your investments, keep reading!

Best AI trading software

There are a number of different AI trading software programs available on the market, each with its own unique features and capabilities. Several of the most popular AI trading software programs include:

#1 EDITORS CHOICE - Ease of INTEGRATION and PRICE

SignalStack

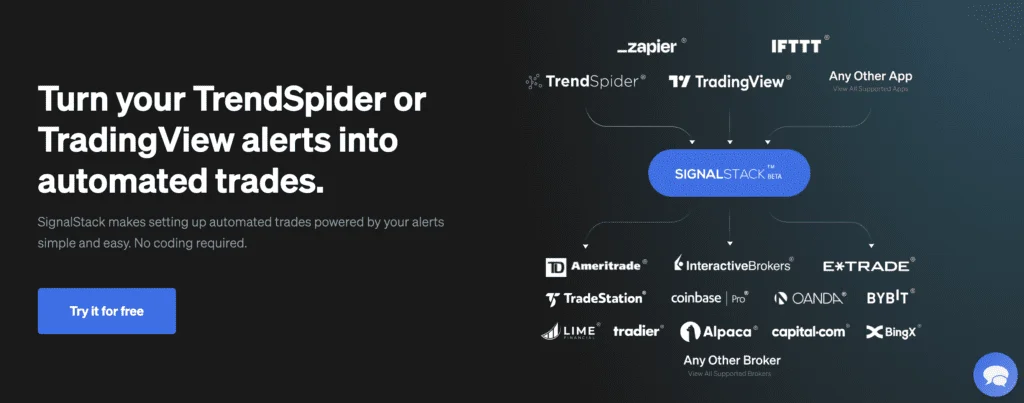

SignalStack is a platform that has made its mark in the world of AI and trading, and we have taken notice! It has been recognized in numerous Trading circles for its unique approach to AI trading by automating alerts from various platforms. As an Artificial Intelligence webhook-based automation tool, it integrates with Tradier, Bybit, Optimus, Alpaca, Auto Shares, BingX, BitMart, BitMEX, Blockchain, Capital, Coinbase Pro, Extrade, Gemini, InteractiveBrokers, Kucoin, Lime, OANDA, Phemex, TastyTrade, TradeStation, WOOX, XIB, TD Ameritrade and TradingView, with new platforms being added regularly. And with 5 Signals a Month for FREE, makes it one of the most versatile and affordable methods of increasing your trade effectiveness with Artificial Intelligence on the market.

Harnessing the Power of AI

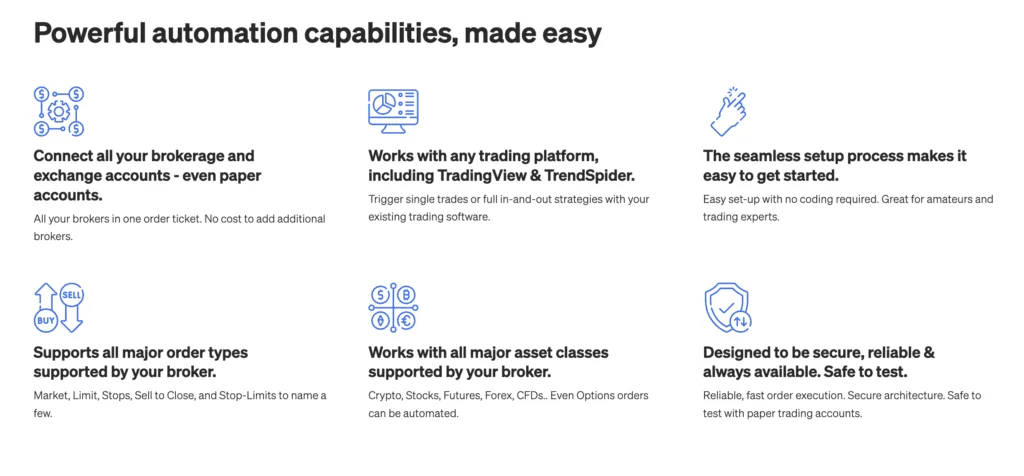

One of the primary features that sets SignalStack apart is its Artificial Intelligence capabilities. By leveraging machine learning algorithms, SignalStack can process and analyze real-time data from various sources. This allows users to gain insights into market trends and make informed decisions based on these insights.

The benefits of using SignalStack are significant. The platform’s semi-automated trading bot improves the trading process by eliminating human tendencies and emotions. Moreover, it offers enhanced productivity, accuracy, and ease of software integration.

User Feedback and Criticisms

However, no tool is without its criticisms. Some users have reported difficulties in setting up automated alerts, while others have voiced concerns over the lack of customer support. While these are common issues for every platform, it is essential to take these criticisms into account when considering whether SignalStack is the right Artificial Intelligence for your trading.

Pricing Tiers and Services

- 5 signals/month ~ FREE (No Credit Card Required)

- 50 signals/month ~ $27/month or $270/year

- 250 signals/month ~ $97/month or $970/year

- 1000 signals/month ~ $347/month or $3,470/year

Final Thoughts

Overall, SignalStack is a powerful tool for anyone interested in harnessing the power of AI for trading. Its ability to integrate with various charting software and its semi-automated trading bot are standout features that differentiate it from other trading platforms.

To sum it up, SignalStack is an innovative platform that seamlessly combines Artificial Intelligence and trading. Its potential to enhance productivity, accuracy, and ease of software integration makes it worth a FREE Test Drive. Get maximum flexibility and only pay for what you use. Full points for this one!

*At the time of this post, SignalStack will integrate with Tradier, Bybit, Optimus, Alpaca, Auto Shares, BingX, BitMart, BitMEX, Blockchain, Capital, Coinbase Pro, Extrade, Gemini, InteractiveBrokers, Kucoin, Lime, OANDA, Phemex, TastyTrade, TradeStation, WOOX, xib, TD Ameritrade, TradingView, IFTTT, Zapier and TradeSpider, with more Brokers and supported apps being added every month.

Tickeron

One-stop platform for trading success.

Tickeron is a one-stop platform that provides detailed information and analysis of stocks through the use of AI Real-Time Patterns, AI Robots, and AI Trend Predictions. Tickeron also has a marketplace where users can exchange trade ideas, and there is a dedicated team of experts available to help users make the best decisions for their portfolios. Tickeron’s features provide an all-inclusive experience for anyone interested in the stock market, and its easy-to-use interface makes it a great choice for both beginners and experienced investors alike.

Key Features:

- Paper trades: Adjust your trading style by reviewing your gains and losses on paper trades without losing any money

- Several helpful tools for traders

- Several helpful tools for investors

- A marketplace full of trade ideas

Pricing:

- Subscribe as a beginner for free

- Intermediate One at $90/month

- Intermediate Two at $120/month

- Expert at $250/month

Best in Class for Artificial Intelligence and Social Investing

eToro (US Residents Only)

*Note: Although eToro has been helping people be successful in investing in the markets since 2007, it is only recently that US Residents have had access to their platform. Therefore, they have a separate portal for residents of the United States which can be reached HERE.

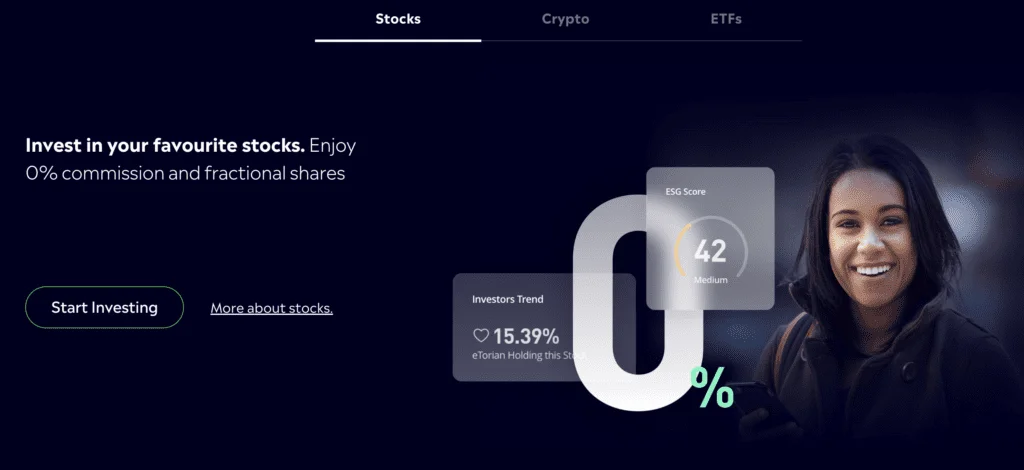

eToro is a leading AI & Social Trading platform that offers a variety of features to its users including the eToro Academy and Social Investing. Founded in 2007, the platform is easy to use and provides access to a wide range of assets, including forex, stocks, and cryptocurrencies, but has only recently been available to investors in the United States. One of the unique features of eToro is the ability to copy the trade decisions of expert investors. This allows users to receive amazing perks for sharing their expert investing decisions with the community. Hence, the term “social investing”.

(eToro USA LLC does not offer CFDs, only real Crypto assets are available.)

In addition, eToro offers a solid trading experience with a minimum deposit of just $50 USD. It has over 3,056 Tradable symbols that also include CFD Trading, US Stock Trading, International Stock Trading, Social Trading, cryptocurrencies, and a lot more. With a trust score of 93 out of 99, eToro is a reliable platform for investment aficionados of all levels of experience

Key Features

- Two mobile apps for crypto and money transfers

- The user design makes navigation easy

- Includes a Standard economic calendar

- Includes an Earnings report calendar

- Provides daily market analysis series and podcasts

- Use Artificial Intelligence to Boost your investing

- Easy & Affordable to get started

Pricing

- Fixed 1% fee for buying and selling trades

- Fixed 1% commission for over 200 crypto assets

- Crypto to crypto transfers at only a 0.1% fee

Does eToro offer training?

Yes! eToro has partnered with e-Careers to offer a fully-funded training course about trading in the financial markets.

*Note: Although eToro has been helping people be successful in investing in the markets since 2007, it is only recently that US residents have had access to their platform. Therefore, they have a separate portal for residents of the United States which can be reached HERE.

(eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation)

eToro (All other Countries)

(eToro Disclaimer: eToro is a multi-asset platform that offers both investing in stocks and crypto assets, as well as trading

CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. Past performance is not an indication of future results. The trading history presented is less than 5 complete years and may not suffice as a basis for investment decisions. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply. eToro USA LLC does not offer CFDs makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity-specific information about eToro.

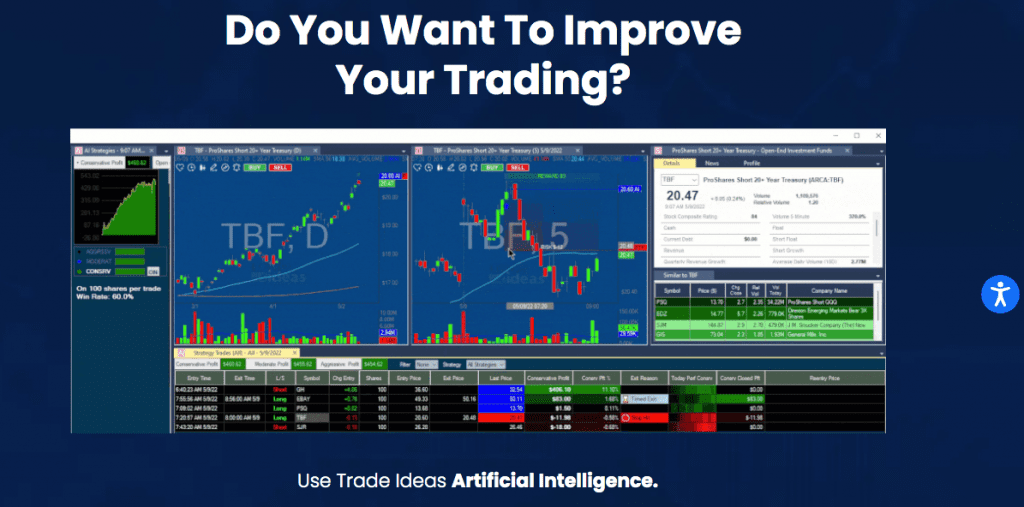

Trade Ideas

Leverage nearly two decades of online, automated trading.

Trade Ideas provides users with alerts for potential trades. The service is designed to be helpful for both entry-level traders and experts. Getting started with Trade Ideas is easy, with classes, webinars, and support, there is enough education and resources for everyone to excel in the field.

Key features

- Real-Time Stock Racing

- Entry & Exit Signals

- Performance Tracking

- $0 commission trading

- Good for all levels of investors

- Entry & Exit Signal

- Performance Tracking

Pricing:

$86.00

$167.00

Monthly and yearly payment plans are available

Making money in the stock market is all about making smart decisions. If you want to be successful at sustainable investing, you will first need to understand how it works. This means studying the fundamentals of environmental and social analysis, as well as learning how to identify stocks that meet your ethical criteria. With a little bit of research and the right tools, you can find opportunities to invest in companies that are committed to creating a more sustainable future. And AI investing software is one of those game-changing tools.

AI trading software is the use of artificial intelligence to make buying and selling decisions in the financial markets. AI trading software is designed to identify profitable trading opportunities and execute trades on behalf of the user. Furthermore, AI trading software can also provide guidance and advice to human traders, helping them to make more informed decisions.

AI is transforming the world of trading. Numerous AI-based trading software programs are now available, and they’re outperforming human traders. They are able to collect, correlate, and analyze information more quickly than humans because they never sleep. So, if you’re looking to get into trading or want to change up your game, then keep reading as we review and compare the Top AI software trading apps.

These apps can be used for a variety of tasks, including analyzing market data, making predictions, and executing trades. And because they’re powered by AI, they can do all of these things faster and more accurately than any human trader.

But there are a few things you need to know in advance before you dive in.

When it comes to trading with AI, you need to understand how it works. After all, you’re trusting your money with a machine. So, before you start using AI trading software, make sure to do your research.

*Note: AI software is not a money machine, but it does allow for better data management. There is always a point where the human decision-making process will be required.

Here are some questions you may want to ask as you start exploring the various platforms:

- Is the software interface easy to use?

- Is it based on historical data or real-time data?

- How accurate are the predictions?

- What is the success rate?

- What fees are involved?

- Do they provide training?

Keep these things in mind and you’ll be able to find the best AI trading software for your needs.

And of course, the primary consideration of any investment, AI-supported or otherwise, is that there will always be risk. With any form of investment, there is always a certain amount of risk involved. So, make sure you understand the risks before putting your money down.

But if you’re ready to take the plunge, then check out our list of the best AI trading software programs below. We’ve compiled a list of the top programs on the market, so you can start trading with the help of AI today. Always remember that investing involves risk and you may lose your invested funds. Play safe.

Happy Trading!

What are the features to look for in AI trading software?

AI trading software is becoming increasingly popular with investors as it promises to offer a more efficient and data-driven approach to trading. However, with so many different options on the market, it can be difficult to know which software is right for you. When selecting AI trading software, there are a few key features that you should look for:

- Ease of use: The software should be easy to navigate and understand, even if you’re not a tech expert.

- Real-time data: The software should provide access to real-time market data so that you can make informed decisions about your trades.

- Flexibility: The software should be flexible enough to accommodate your unique investment strategies.

- Customer support: In case you run into any issues with the software, it’s important to have access to quality customer support.

- Low-risk: Look for software that offers a demo account or other risk-management features so that you can test it out before committing any real money.

- Pricing: The cost of AI trading software can vary depending on the features and functionality that you need. Some basic software packages may be as low as $50 per month, while more comprehensive packages can cost upwards of $500 per month.

By keeping these features in mind, you can narrow down your options and find the best AI trading software for your needs.

AI trading software can offer a number of benefits for investors, including:

- The ability to trade 24/7, automated order execution, and the ability to backtest strategies.

- Perhaps the most significant advantage of AI trading software is the ability to identify and take advantage of trading opportunities that might be missed by human traders.

- By using predictive analytics, AI trading software can scan the markets for potential opportunities and execute trades in real time. This can help investors to maximize their profits and minimize their losses.

- By reacting objectively to market conditions, AI trading software can help traders avoid common pitfalls such as fear-based selling and greed-driven buying.

- AI trading software can help to remove emotions from the trading process, which can lead to more rational and profitable decision-making.

Overall, AI trading software can be a valuable tool for any investor who is looking to take their trading to the next level.

In conclusion on forex, stock, and ETF trading with AI software

If you’re looking for a way to increase your profits, you should consider AI trading software. This type of software uses artificial intelligence to make trades on your behalf, and it can be an effective way to improve your bottom line. There are a number of different AI trading software options available, so be sure to do your research to find the one that best suits your needs. With the right software in place, you could see a significant boost in your profits. So if you’re ready to start making more money from your investments, then be sure to check out the above-mentioned AI trading software programs today.

AI Trading Software FAQ

What is AI stock trading?

AI stock trading is a method of stock trading that uses artificial intelligence to make decisions about when to buy and sell stocks. AI stock trading systems are designed to mimic the decision-making process of human traders, but they can also execute trades much faster and with greater accuracy.

What are the benefits of using AI stock trading?

There are many benefits to using AI stock trading, including the ability to trade with greater speed and accuracy than human traders, the ability to make decisions based on a wider range of data points, and the ability to execute trades automatically. And they never need to rest.

What are some of the risks associated with AI stock trading?

AI stock trading systems are expensive to develop and maintain. There is always risk associated with any type of stock trading, but the risks associated with AI stock trading should be carefully considered before investing. The risks associated with AI trading would be with the software developer or with the security of the system.

What is the best AI stock trading software?

The best AI stock trading software is the one that meets your specific needs and requirements. There are many different AI stock trading systems on the market, so it is important to do your research before selecting one. When selecting an AI stock trading system, you should consider factors such as cost, features, ease of use, training, and support.

What is the future of AI stock trading?

The future of AI stock trading is uncertain. The technology is still in its early stages and it will likely take some time for AI stock trading systems to become widely adopted. However, the potential benefits of using AI stock trading systems are significant, and the technology is expected to continue to evolve and improve over time. But a lot of people are having a lot of success with the aid of AI trading software.

What are some of the best AI stock trading software?

There is no one-size-fits-all answer to this question, as the best AI stock trading software will vary depending on your individual needs and preferences. However, some of the best AI stock trading software on the market include MetaTrader 4, MetaTrader 5, Zignaly, and Ticketon.

How do I get started with AI stock trading?

If you’re interested in getting started with AI stock trading, there are a few things you’ll need to do: first, find a good stock trading platform that offers AI capabilities, and then find a good AI stock trading software that meets your specific needs. Once you’ve found a good platform and software, you’ll need to set up an account and fund it with money that you’re willing to risk. After that, you’ll be ready to start trading!

Is AI trading profitable?

There is no guaranteed way to make money through stock trading, and AI trading is no exception. However, many people have found success with AI trading, and it is possible to make a profit through AI trading if you are careful and strategic in your approach.

What are some of the best tips for using AI stock trading software?

Some tips for using AI stock trading software include: being careful and strategic with your trades, doing your research before selecting a software or platform, and starting with a small amount of money that you’re willing to risk. Additionally, it’s important to keep an eye on the market and monitor your AI system to ensure that it is performing as expected.

Which is the best-automated trading software?

There is no one “best” automated trading software. The best software for you will depend on your individual needs and preferences. Some factors to consider when choosing automated trading software include cost, features, ease of use, training, and support.

How much does AI stock trading software cost?

The cost of AI stock trading software varies depending on the specific software and features you select. Generally, the more features and functionality you want, the higher the cost will be. However, there are many affordable AI stock trading software options on the market, so it is possible to find a good option without breaking the bank.

Can I use AI stock trading software on a Mac?

Yes, you can use AI stock trading software on a Mac. However, not all software is compatible with all operating systems, so it is important to check the compatibility of the software before purchasing it.

Can I use AI stock trading software on a mobile device?

Yes, you can use AI stock trading software on a mobile device. However, not all software is compatible with all devices, so it is important to check the compatibility of the software before purchasing it.

What is the best free AI stock trading software?

There is no one “best” free AI stock trading software. The best software for you will depend on your individual needs and preferences. Some factors to consider when choosing automated trading software include cost, features, ease of use, training, and support.

How accurate is AI trading?

The accuracy of AI trading depends on a number of factors, including the specific software you’re using, the quality of data you’re using for training, and the market conditions. In general, AI trading is more accurate than traditional methods of stock trading. You might also be interested in Quant Trading strategies.

How does AI trading software help with Day trading strategies?

Artificial intelligence trading software is designed to help traders within the day trading strategies space by providing them with an edge over their competitors. AI trading software can provide day traders with the ability to analyze data faster, identify market trends and opportunities more easily, and make decisions based on real-time market conditions. While there is no guarantee that using AI trading software will always result in profits, it can certainly give day traders an advantage.

Do trading bots make money?

There is no guaranteed way to make money through stock trading, and bots are no exception. However, many people have found success with bots, and it is possible to make a profit through bot trading if you are careful and strategic in your approach.

What is the best AI trading software for beginners?

The best AI trading software for beginners will depend on your individual needs and preferences. Some factors to consider when choosing automated trading software include cost, features, ease of use, training, and support.

What is the best AI trading software for experienced traders?

The best AI trading software for experienced traders will depend on your individual needs and preferences. Some factors to consider when choosing automated trading software include cost, features, ease of use, training, and support.

Do I need to be an expert to use AI trading software?

No, you don’t need to be an expert to use AI trading software. However, it is helpful to have some knowledge of the stock market and trading before using this type of software. Many AI trading software platforms offer training and support to help you get started.

Can I use AI trading software on a demo account?

Yes, you can use AI trading software on a demo account. This can be a great way to test out the software and see how it works before committing to using it with real money.

Is automated trading profitable?

There is no guaranteed way to make money through stock trading, and automated trading is no exception. However, many people have found success with automated trading, and it is possible to make a profit through this type of trading if you are careful and strategic in your approach.

What are the risks of AI trading?

The risks of AI trading include: overfitting, data quality, and market conditions. Overfitting is a common issue with machine learning models and can occur when the model is trained on too few data points or when the data is not representative of the broader market. Data quality is also a concern, as AI trading software relies on high-quality data for training. Finally, market conditions can impact the performance of AI trading models, as they may be less effective in volatile or unpredictable markets.

Do forex robots make money?

There is no guaranteed way to make money through forex trading, and robots are no exception. However, many people have found success with forex robots, and it is possible to make a profit through this type of trading if you are careful and strategic in your approach. And yes, there are plenty of people making money in the forex markets right now using AI.

What is meant by ESG investing?

ESG investing is an investment strategy that considers environmental, social, and governance factors in addition to financial considerations. The goal of ESG investing is to generate both financial returns and positive social and environmental impact. Many investors believe that companies with strong ESG practices will outperform their peers over the long term.

You will probably also want to read Copy Trading: The Wisdom of the Crowd

What is an example of an ESG stock?

Some examples of ESG stocks include Tesla (TSLA), Patagonia, and Unilever (UL). These companies have all been leaders in environmental and social responsibility, and have generated strong financial returns for investors.

What is an impact investing fund?

An impact investing fund is a fund that invests in companies or projects that are expected to generate positive social or environmental impact. Impact investing funds typically target a specific issue or sector, such as clean energy or education.

What is an example of an impact investing fund?

Some examples of impact investing funds include the Calvert Social Index Fund, the Goldman Sachs Sustainability US Equity Fund, and the JP Morgan Social Growth Fund.

What is an ESG ETF?

An ESG ETF is an exchange-traded fund that tracks a basket of companies that have been selected for their environmental, social, and governance practices. These ETFs allow investors to gain exposure to the growing market for ESG investments without having to pick individual stocks.

Is ESG investing good?

There is no easy answer to this question. Some people believe that ESG investing leads to better financial returns, while others believe that it is more important to focus on the social and environmental impact of investments. Ultimately, each investor will need to decide what is most important to them when considering an investment.

What is ESG and how does it work?

ESG stands for environmental, social, and governance. It is a framework for considering the non-financial impact of investments. ESG factors can include things like a company’s carbon emissions, its treatment of employees, and its compliance with environmental regulations.

What are the benefits of ESG investing?

The benefits of ESG investing include improved financial returns, reduced risk, and increased social and environmental impact.

What are some risks of ESG investing?

The risks of ESG investing include a lack of data, the potential for greenwashing, and underperformance in periods of market stress.

What is the difference between responsible investing and ESG investing?

Responsible investing is an umbrella term that includes ESG investing. responsible investing considers a broad range of environmental, social, and governance factors in addition to financial considerations. ESG investing focuses specifically on environmental, social, and governance factors.

What is sustainable investing?

Sustainable investing is an investment strategy that considers environmental, social, and governance factors in addition to financial considerations. The goal of sustainable investing is to generate both financial returns and positive social and environmental impact. Many investors believe that companies with strong sustainable practices will outperform their peers over the long term.

What is socially responsible investing?

Socially responsible investing (SRI) is an investment strategy that considers environmental, social, and governance factors in addition to financial considerations. The goal of SRI is to generate both financial returns and positive social and environmental impact. Many investors believe that companies with strong ESG practices will outperform their peers over the long term.

What are some examples of socially responsible investments?

Some examples of socially responsible investments include renewable energy, fair trade, and green infrastructure building.

What is the difference between impact investing and socially responsible investing?

Impact investing is an investment strategy that focuses on companies or projects that are expected to generate positive social or environmental impact. Socially responsible investing (SRI) is an investment strategy that considers environmental, social, and governance factors in addition

Why is ESG investing important?

ESG investing is important because it allows investors to consider the non-financial impact of their investments. ESG factors can have a significant impact on a company’s financial performance, and by considering these factors, investors can make more informed investment decisions.

What do ESG funds invest in?

ESG funds can invest in a wide range of companies and projects, depending on the goals of the fund. Some ESG funds focus on investments that have a positive social or environmental impact, while others seek to avoid investments with negative ESG impacts.

What is an ESG rating?

An ESG rating is a rating that assesses a company’s or project’s environmental, social, and governance impacts. ESG ratings can be used by investors to help make more informed investment decisions. An ESG rating is a score that rates a company or project on its environmental, social, and governance impacts. The higher the score, the better the company or project’s ESG performance.

What is an ESG index?

An ESG index is an index that tracks the performance of companies or projects that have strong environmental, social, and governance practices. ESG indexes can be used by investors to help make more informed investment decisions.

Can AI software help with sustainable investing?

Yes, AI software can help with sustainable investing by providing investors with data and insights on a company’s or project’s ESG impacts. This information can be used to make more informed investment decisions. Additionally, some AI software programs can automate sustainable investing processes, such as portfolio construction and impact measurement.

What is an impact bond?

An impact bond is a type of bond that is issued to finance projects that are expected to generate positive social or environmental impacts. Impact bonds are often used to finance projects in areas such as education, health, and environmental protection.

What is a green bond?

A green bond is a type of bond that is issued to finance projects that are expected to generate positive environmental impacts. Green bonds are often used to finance projects in areas such as renewable energy, energy efficiency, and green infrastructure.

What is a social bond?

A social bond is a type of bond that is issued to finance projects that are expected to generate positive social impacts. Social bonds are often used to finance projects in areas such as education, health, and poverty alleviation.

Does ESG investing make a difference?

Yes. ESG investing can make a difference by helping to finance projects and companies that are expected to generate positive social or environmental impact. Additionally, ESG investing can help to raise awareness of environmental, social, and governance issues.

What is the Global Sustainable Investment Alliance?

The Global Sustainable Investment Alliance (GSIA) is a network of sustainable investment organizations from around the world. The GSIA promotes sustainable investing and encourages collaboration among its members.

What are the United Nations Principles for Responsible Investment?

Broker Descriptions

Tradier – Tradier is a revolutionary investing platform that allows investors to trade stocks, options, and futures all in one place. With Tradier, you’ll have access to powerful trading tools and real-time data that will help you make smarter investment decisions. Whether you’re an experienced trader or just getting started, Tradier is the perfect platform to help you grow your portfolio and achieve your financial goals.

Bybit – Bybit is a cutting-edge trading platform that specializes in cryptocurrency derivatives. With Bybit, you’ll be able to trade Bitcoin and other popular digital currencies with ease, thanks to their intuitive interface and powerful trading engine. Whether you’re a seasoned crypto investor or just getting started, Bybit is the perfect platform to help you make the most of this exciting and fast-growing market.

Optimus – Optimus is a unique investing platform that offers a wide range of products and services for traders of all levels. With Optimus, you’ll have access to a variety of useful tools and resources that will help you make smarter investment decisions and grow your portfolio over time. Whether you’re interested in stocks, options, or futures, Optimus has something for everyone.

Alpaca – Alpaca is a cloud-based investing platform that provides traders with access to powerful technology and real-time data. With Alpaca, you’ll be able to trade stocks, options, and ETFs with lower transaction costs and faster execution times than traditional brokerage firms. Whether you’re a seasoned investor or just getting started, Alpaca is the perfect platform to help you unlock your full potential.

Auto Shares – Auto Shares is a trading platform that specializes in automated trading strategies. With Auto Shares, you’ll be able to set up your own custom trading bots that will execute trades on your behalf, based on your specific investment goals and risk tolerance. This innovative platform is perfect for investors who are looking to take a hands-off approach to investing, or who want to leverage the power of automation to maximize their returns.

BingX – BingX is a powerful investing platform that provides users with access to a variety of investment opportunities, including stocks, bonds, and cryptocurrencies. With BingX, you’ll be able to trade on global markets and take advantage of real-time data and analytics to make smarter investment decisions. Whether you’re a seasoned investor or just getting started, BingX is the perfect platform to help you build your portfolio and achieve your financial goals.

BitMart – BitMart is a global trading platform that specializes in cryptocurrencies and digital assets. With BitMart, you’ll be able to trade on a wide range of markets and access real-time data and advanced trading tools. Whether you’re a seasoned crypto investor or just getting started, BitMart is the perfect platform to help you navigate this exciting and fast-growing market.

BitMEX – BitMEX is a cutting-edge investing platform that specializes in high-leverage cryptocurrency derivatives. With BitMEX, you’ll be able to trade on a variety of markets and access real-time data and advanced trading features. This platform is perfect for experienced investors who are looking to take advantage of the potential rewards of high-leverage trading.

Coinbase Pro – Coinbase Pro is a powerful trading platform that provides users with access to a variety of cryptocurrencies and digital assets. With Coinbase Pro, you’ll be able to trade on global markets and access advanced trading features and real-time data. Whether you’re a seasoned crypto investor or just getting started, Coinbase Pro is the perfect platform to help you achieve your investment goals.

Extrade – Extrade is a global trading platform that provides users with access to a wide range of financial instruments, including stocks, options, and futures. With Extrade, you’ll be able to trade on major global markets and access advanced trading features and tools. Whether you’re an experienced trader or just getting started, Extrade is the perfect platform to help you grow your portfolio and achieve your financial goals.

Gemini – Gemini is a powerful investing platform that specializes in cryptocurrencies and digital assets. With Gemini, you’ll be able to trade on a variety of markets and access real-time data and advanced trading features. Whether you’re a seasoned crypto investor or just getting started, Gemini is the perfect platform to help you navigate the exciting and fast-growing world of cryptocurrencies.

InteractiveBrokers – InteractiveBrokers is a comprehensive investing platform that provides users with access to a wide range of financial instruments, including stocks, options, futures, and forex. With InteractiveBrokers, you’ll be able to trade on major global markets and access advanced trading features and tools.

Kucoin – Kucoin is a leading cryptocurrency exchange that offers a highly secure and user-friendly trading platform to facilitate seamless trading of an extensive range of digital assets. With advanced trading tools and a reliable withdrawal and deposit system, Kucoin is the perfect platform for both novice and experienced traders looking to explore the world of cryptocurrency.

Lime – Lime is an investment platform that is revolutionizing the way people invest by offering fractional shares of some of the world’s most sought-after companies. It is an easy-to-use platform that provides a range of investment options, including stocks, ETFs, and cryptocurrencies. With Lime, investors can create a diversified portfolio with as little as $1, making it accessible to everyone.

OANDA – OANDA is a global online trading platform that offers transparent pricing and competitive spreads for forex and CFD trading. With advanced tools and analytics, paired with educational resources, OANDA provides traders with the tools they need to make informed decisions. The platform also offers mobile trading, allowing traders to stay connected and execute trades on the go.

Phemex – Phemex is a leading cryptocurrency derivatives trading platform that offers a range of features and tools to help traders stay ahead of the game. Phemex offers a safe and reliable trading experience backed by a robust security system that includes bank-level encryption and multi-factor authentication. The platform also offers lightning-fast transaction speeds and advanced trading tools designed to help traders maximize their profits.

TastyTrade – TastyTrade is an online financial network that provides traders with expert advice, educational resources, and high-quality content to help them navigate the complex world of trading successfully. With an emphasis on options trading, TastyTrade provides traders with a platform that has everything they need to succeed in any market condition.

TradeStation – TradeStation is an all-in-one trading platform that provides traders with the tools they need to succeed, including powerful charting, backtesting capabilities, and customizable trading strategies. The platform offers low commission rates and fast trade executions, making it an ideal platform for active traders and investors.

WOOX – WOOX is a blockchain-based investing platform that uses innovative technology to provide investors with a secure, transparent, and decentralized platform to invest in a range of assets. With low fees and a highly liquid market, WOOX offers a unique investment opportunity for those looking to explore the world of blockchain and cryptocurrency.

xib – xib is an investment platform that offers real estate investment opportunities to accredited investors. With a focus on commercial real estate, xib provides investors with access to a range of high-return investment opportunities across multiple asset classes.

TD Ameritrade – TD Ameritrade is a widely recognized online broker that offers a range of investment options, including stocks, options, ETFs, and mutual funds. With a user-friendly platform and low commission rates, TD Ameritrade is an ideal platform for both novice and experienced traders looking to expand their investment portfolio.

TradingView – TradingView is a leading web-based charting platform that offers a range of analytical tools and interactive charts to help traders make informed trading decisions. With a social community of traders and investors, TradingView provides users with a collaborative and engaging platform to learn and share trading ideas.

Blockchain – blockchain.com is a leading cryptocurrency wallet and blockchain explorer that provides users with a secure and user-friendly platform to manage their digital assets. The platform supports multiple cryptocurrencies, including Bitcoin and Ethereum, and offers a range of features, including a built-in exchange, lending, and mobile app support. With over 60 million wallets created, Blockchain is a trusted platform for both novice and experienced cryptocurrency users.

AUTHOR BIO

Research & Curation

Dean Emerick is a curator on sustainability issues with ESG The Report, an online resource for SMEs and Investment professionals focusing on ESG principles. Their primary goal is to help middle-market companies automate Impact Reporting with ESG Software. Leveraging the power of AI, machine learning, and AWS to transition to a sustainable business model. Serving clients in the United States, Canada, UK, Europe, and the global community. If you want to get started, don’t forget to Get the Checklist! ✅