What is Risk Management in Internal Audit?

What is Risk Management in Internal Audit?

“Risk management is the identification, assessment, and prioritization of risks that may impact an organization. It is a process which can be applied to any aspect of life.”

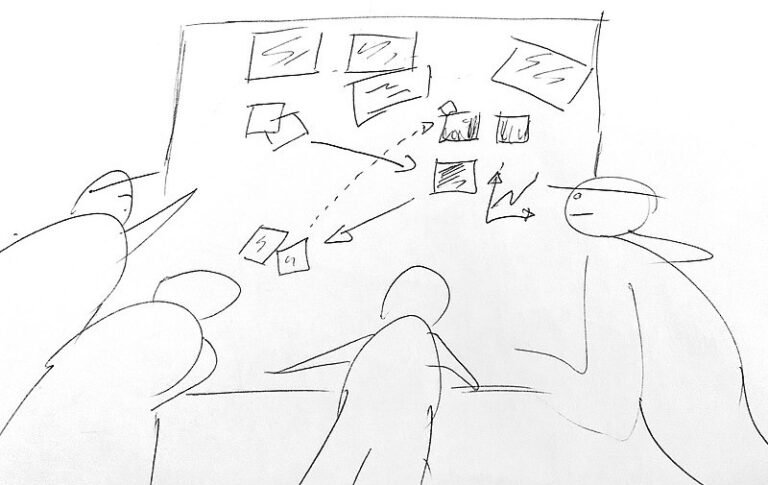

What does this mean for internal audits? Internal auditors are responsible for evaluating risk in their company or organization. This includes assessing the potential risks involved with policies, procedures, operational controls, and other aspects of business operations. The auditor then prioritizes these risks based on their likelihood and impacts to determine where they need to spend more time conducting testing.

Risk management is a key part of the internal audit process, and it can be defined as “the identification and evaluation of risks to organizational objectives.” Internal auditors need to identify how changes in different areas could affect an organization’s ability to achieve its goals. They will then work with the Board and senior managers to develop strategies for managing those risks.

Why do an internal audit?

Internal audits are conducted periodically or when there is a change in circumstances that might lead to increased risk. The results of the audit are used internally by senior management, who have responsibility for overseeing all aspects of their company’s operations.

How is an internal audit important for risk management?

This is a good question. Let us start by stating that risk management is the identification, assessment and prioritization of risks. Internal auditors make sure their company or organization has identified the correct risks involved with aspects such as policies, procedures, operational controls and more. They prioritize these risks based on their likelihood and impacts to determine where they need to spend more time conducting testing. Risk is what will affect the sustainability of the company, its employees, the communities it serves and all other stakeholders.

What is the main difference between risk management and internal audit?

The main difference between risk management and internal audit is the fact that while both are involved with identifying risks, risk management focuses more on assessing their impacts in order to determine how they can be managed. The auditor then helps senior leadership strategize ways of managing these risks.

Risk management is the process of identifying, assessing, and responding to risks. Internal control is a set of processes and procedures that are designed to ensure that an organization’s resources are safeguarded and its goals are met. Risk management is concerned with managing risks so that they do not adversely affect an organization’s ability to achieve its objectives. Internal control is focused on preventing and detecting errors and fraud. Risk management is a proactive process, while internal control is reactive. Risk management should be used in conjunction with internal control to improve an organization’s overall risk posture.

What are the 3 types of audit risk?

There are many types of audit risk, but the main three are:

- Financial risk: This is the risk that an organization will not be able to meet its financial obligations.

- Operational risk: This is the risk that an organization will not be able to operate successfully due to a failure in process, people, or systems.

- Strategic risk: This is the risk that an organization’s strategic objectives will not be achieved.

How do internal audits help in the management of compliance risk?

Internal audits help organizations manage compliance risk by assessing how well an organization is complying with its regulatory requirements. Internal auditors use a variety of techniques, such as interviews, document reviews, and observations, to identify areas where an organization may be at risk for noncompliance. They then develop recommendations to help management address these risks. You might also want to set goals with your team.

Why internal auditors should ensure the effectiveness of risk management?

An internal auditor should ensure the effectiveness of risk management in an organization because internal controls are one of the best ways to understand how risks are being managed. The objectives, scope, and limitations for carrying out a risk-based audit should be defined so that it helps provide evidence on compliance with laws, regulations, etc., which is suitable for making decisions about changes or improvements needed in an organization’s risk management processes.

What are the benefits of internal audits?

There are many benefits to conducting internal audits, including reducing risk and improving organizational efficiency. By identifying risks and weaknesses within an organization, many internal auditors can help management make better decisions about where to allocate resources in order to improve performance. Additionally, by providing assurance that controls are effective and efficient, internal auditors can help organizations meet compliance requirements.

Internal audits also provide value to individual employees. By identifying areas in which employees need to improve their performance, internal audits can help them become more effective and efficient members of the organization. Additionally, by highlighting instances of good performance, internal audits can help employees feel appreciated and recognized for their contributions. Overall, an internal audit team provides a number of benefits to organizations and individuals alike.

You can’t improve what you don’t measure.

Free Verified Carbon Calculators.

What is an enterprise risk management framework?

An enterprise risk management framework is a collection of policies, procedures, and controls that are designed to help organizations identify, assess, manage, and monitor risks.

- An enterprise risk management framework helps organizations better allocate resources by identifying threats and opportunities related to their core business functions. It also allows managers to measure performance against metrics that align with the objectives set forth in an organization’s strategic plan.

- Enterprise risk management frameworks can also help organizations meet compliance requirements and make better investment decisions by identifying, assessing, and monitoring risks related to the achievement of specific goals.

- Internal auditors use enterprise risk management as a framework for conducting audits because it helps them identify areas in which an organization may have vulnerabilities that could lead to failure or fraud.

Overall, enterprise risk management frameworks help organizations meet their objectives by assessing and monitoring risks that could affect the achievement of those goals.

Risk is what will affect the sustainability of the company, its employees, the communities it serves and all other stakeholders.

How do you conduct an internal audit?

While there are many elements that go into an internal audit and many industry-specific standards that must be followed, there are a few general steps that all internal audits follow.

- The first step in any internal audit is to develop an understanding of the organization’s risk profile. This includes assessing the types of risks the organization faces, as well as how severe those risks could be.

- After developing an understanding of the organization’s risk profile, the internal auditor then identifies the controls that are in place to mitigate those risks. This includes reviewing policies and procedures, as well as interviewing employees who have knowledge of the organization’s operations.

- Once the internal auditor has a good understanding of the risk and control environment, they will begin to test the effectiveness of those controls by conducting process walks or interviews with employees, reviewing documentation, and using other analytical methods.

- Finally, the auditor will compile their findings into a report and make recommendations to management on how to address any deficiencies that were identified.

While the steps outlined above provide a general overview of the internal audit process, there are many variations depending on the organization being audited and the specific standards that must be followed.

Overall, an internal audit provides valuable information on how well an organization is performing against its objectives by assessing the control

Caveats, disclaimers & honorable mentions

At ESG | The Report, we believe that we can help make the world a more sustainable place through the power of education. We have covered many topics in this article and want to be clear that any reference to, or mention of the key focus on risk information which is designed to provide assurance in the audit universe. Many companies provide advice from their ERM team regarding the adequacy of an audit plan to provide independent assurance. But it all depends on business risks and the risk committees’ tolerance(risk appetite). If mentioned in the context of this article is purely for informational purposes and not to be misconstrued as investment or any other legal advice or an endorsement of any particular company or service. Neither ESG | The Report, its contributors their respective companies nor any of its members gives any warranty with respect to the information herein and shall have no responsibility for any decisions made, or actions taken or not taken which relate to matters covered by ESG | The Report. As with any investment, we highly recommend that you get a financial advisor or investment adviser, and do your homework in advance of making any moves in the stock market. Thank you for reading, and we hope that you found this article useful in your quest to understand ESG and sustainable business practices. We look forward to building a sustainable world with you.

AUTHOR BIO

Research & Curation

Dean Emerick is a curator on sustainability issues with ESG The Report, an online resource for SMEs and Investment professionals focusing on ESG principles. Their primary goal is to help middle-market companies automate Impact Reporting with ESG Software. Leveraging the power of AI, machine learning, and AWS to transition to a sustainable business model. Serving clients in the United States, Canada, UK, Europe, and the global community. If you want to get started, don’t forget to Get the Checklist! ✅